A stock pitch that doesn’t talk about AI. Special situations, homebuilders.

Lennar Corporation $LEN

Overview

Lennar($Len) is one of the largest homebuilders in the United States. Although housing has been in a rut as of late, there are 3 reasons Lennar could be more attractive to equity investors in the future. 1. Lennar is pursuing a capital-light and asset-light strategy and has spun off its land holdings into a separate company called Millrose Properties, which can boost profitability. 2. Its acquisition of Rausch Coleman gives access to an attractive market 3. A pickup in the housing market in the United States driven by a reduction in interest rates drives demand for home sales.

Investment Case

· Lennar’s spinoff of its land assets into a separate company can boost the profitability and return for the company,

· Lower interest rates going forward can increase demand for housing by making housing more affordable

· Evidence of disciplined capital allocation by management

· Strong balance sheet with a low debt-to-equity ratio

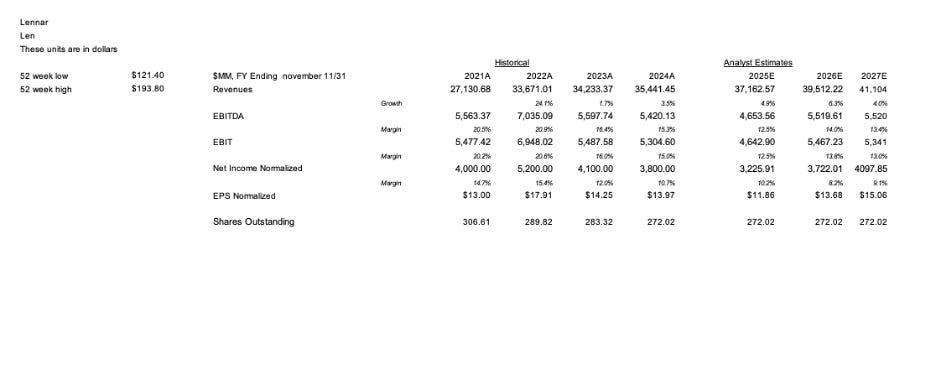

· I am putting a one-year price target of $170.50 based on an EPS of $15.50 and a P/E ratio of 11x, this would be an upside of 40%

Why does this opportunity exist?

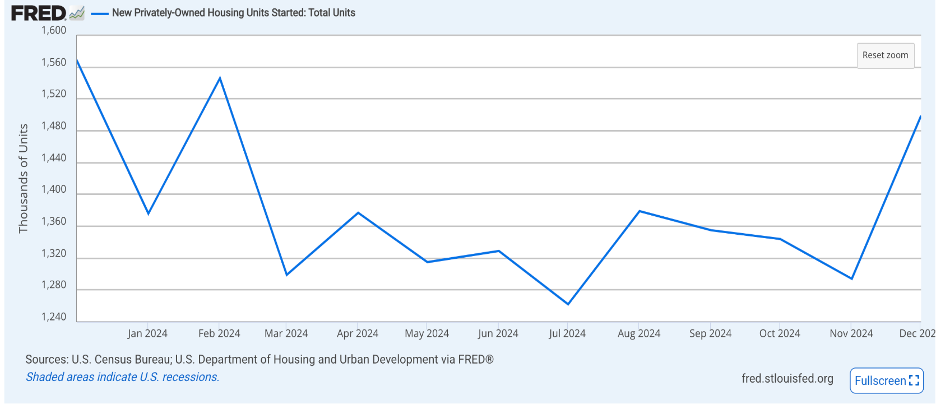

Upon first glance, the sentiment for housing along with the spinoff makes Lennar seem quite negative which creates an opportunity for investors to pick up Lennar at a discount. In my view, the spinoff has set up Lennar to excel in the next two to three years as housing recovers. Housing starts, which is a leading indicator for new construction projects, have begun to recover and as interest rates begin to come down in the next few years it can act as an external tailwind for Lennar. Additionally, since management must have anticipated a slower period, it seems like they have spent a lot of time improving the financials of the company internally. Lennar is on track to become a different company than it once was. The land-light and asset-light strategy will reduce the capital going forward and boost the return on equity.

Spinoff

First up, let’s talk about the spinoff. On 2/7/2025 shareholders of Lennar will receive a share of Millrose Class A(1 vote per share, MRP) or Class B(10 votes per share, MRP WI) for every two shares of Lennar owned(Lennar Press Release). 80% of the shares will be distributed to shareholders while Lennar will retain 20% and later dispose of the shares. As part of the spinoff, Millrose will receive Lennar’s Homesite Option Purchase Platform(HOPP’R) which is used for land management. The idea here is that Millrose will develop the land and provide it to Lennar on a ‘just-in-time basis.’ Lennar benefits because it will be able to purchase an option to gain control of the land instead of purchasing the land outright and holding it on the balance sheet. This allows Lennar to significantly lower its capital cost and make it a pure-play home builder. Typically, homebuilders not only build the home, but they play the land banking game where they purchase land as well. By using land options Lennar will be able to put a small amount down to gain control of the homesite which will boost its capital efficiently. In this way, Lennar will be moving to a land and asset-light business model. Lennar will have exclusive rights to purchase land from Millrose and Millrose will use the capital it received to fund future land acquisitions. There is one other publicly traded homebuilder called NVR that follows this strategy. If we compare Lennar’s debt to equity and NVR’s debt to equity, we can see that as of 11/30/2024 Lennar had an ROE of 14.5%(Debt to Equity of 24.2% ) while NVR had a ROE of almost 40%(Debt to Equity of 15.9% ) as of 12/31/2024. I included the debt to equity here because homebuilders can juice up their ROE by taking on debt which can make it difficult to compare. Also, this model would help align net income and free cash flow. When homebuilders make large purchases of land the free cash flow can drop while the net income stays the same and the land is expensed as cost of goods sold. The purchased land would be held under inventories. So instead of outlaying all that cash, Lennar would be able to put down a small amount of money to gain control of the home homesite and pay as they complete the project. Ultimately with this new business model, Lennar should see stronger margins, better inventory turnover, and a strong balance sheet when compared to its peers. Aside from NVR, which pioneered the land-light and asset-light business model. Now let’s move on the Lennar’s recent acquisition.

Acquisition of Rausch Coleman LLC

As part of the transaction, Millrose will receive about 5.2 billion in in undeveloped and partially developed land and about 1 billion in land. Millrose will also get 900 million in land assets as part of the Rausch Coleman acquisitions. RC builds homes in 12 markets and across 7 states, it will add 4000 new orders in 2025. What I like about this acquisition is that RC sells homes with a lower sales price of 230000(Lennar Investor Relations). Affordability of homes is a growing concern and having delivery of homes that have a lower sales price should drive volume. This would add about 920 million in sales for Lennar. 75% of the deliveries are anticipated to be in areas that Lennar doesn’t currently operate in.

Recovery in the housing market

In the last few years, the housing market hasn’t been great, but looking forward there may be some recovery. After the 2008 housing crisis, there has been a shortage in the supply of homes. Also, now, many homebuyers are unable to comfortably afford a home because high interest rates prevent hurts affordability. In 2025 and beyond the expectations, the interest rates will come down which can help drive demand. Also, there has been an uptick in housing starts (Reuters, St.Louis Fed).

Financial Analysis and Valuation

Lennar has a strong balance sheet, which has allowed it to transition to the asset-light and land-light balance sheet. I want to highlight the financial profile has changed and will likely continue to change. In the past few years, we have seen debt to equity go down from about 40% to about 15.89%. This will free up cash flow for equity holders. There has also been an uptick in capital expenditures, which means that Lennar is anticipating an increase in its operation and is stocking up supply. This could be a leading indicator for sales growth in the future.

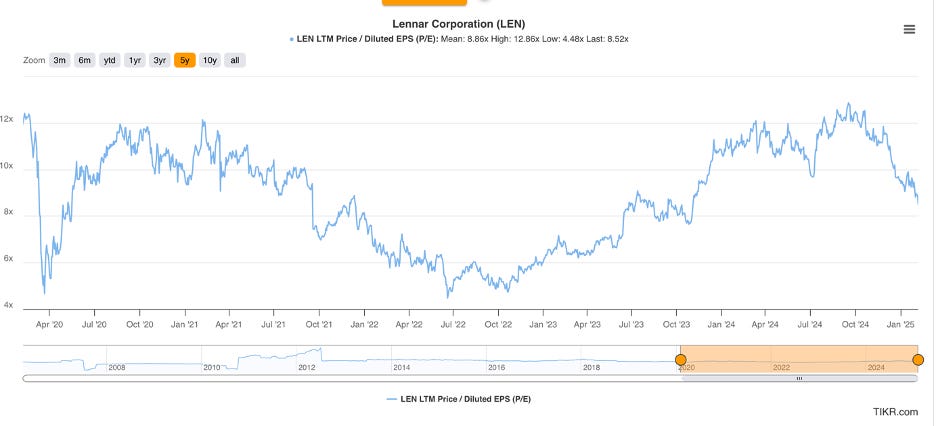

As for the valuation, Lennar trades closer to the lower end of its valuation, and Lennar trades closer to the low end of its P/E of 8x-9x. This is understandable as they have had weakness in revenue, margins, and net income. When the rates rise there is a possibility of increased revenue and margins. Additionally, the new land-light and asset-light business model can make the company more profitable in the future, and that could also boost the multiple. I don’t want to be too optimistic in my multiple expansion, so I am going to forecast 1x to 2x in the multiple which is still well below its 10-year high of 21.25x. Please refer to the P/E chart, model, and valuation table below.

Risks

1. Affordability is a concern, if housing prices increase sharply it may dampen demand and/ or if interest rates stay high, the average housing payment may still be out of reach for many Americans

2. Integration risk – There may be challenges integrating Rausch Coleman LLC into its business model

3. Tariff risk- Although a host of Lennar’s suppliers are domestic, many of their electronics components come from China, and tariffs could make these purchases more expensive.

4. Labor expense - if the federal government is less immigration friendly it could increase the cost of labor and that would eat into profit margins.