Get involved with the renewable energy boom in Europe with this niche solar player.

Make money and virtue signal about how you're not only a capitalist but also help saving the planet by investing in renewable energy

Introduction

Enphase Energy(ENPH) sells microinverters for solar panel systems batteries, EV chargers, and other hardware and provides proprietary software to manage these devices(Enphase 10k). There are new regulations in Europe that can help increase Enphase's revenue growth

In the future, more of Enphase’s Revenue will come from international markets due to increased regulations and organic demand for solar energy. In 2021, 80% of Enphase’s Revenue came from the United States. By 2023, 64% of revenue came from the United States. Enphase also plans to expand into new markets; revenue growth can come from markets such as the Netherlands, France, Germany, Italy, Australia, Brazil, Mexico, India, Thailand, and the Philippines(Q1 2024 Earnings Call). Europe has passed many laws that support the growth of solar. The European Parliament has passed the EU Solar Standard, which requires solar panels on European buildings. The directive outlines the following,” sets a timeline of integrating solar installations into building works of new commercial and public buildings by 2026, on commercial and public buildings that undergo relevant renovations by 2027, on new residential buildings by 2029 and on existing public buildings by 2030(PV Magazine).”

Like other markets, the United States government has also adopted regulations promoting solar energy. Although NEM 3.0 has reduced the net metering rates in California, there is still a positive ROI for having solar. It would require a longer payback time and attaching a battery. Take this example from the LA Times, “Under the old rules, the expected “payback period” for homes served by Edison and PG&E was five to six years, according to an industry trade group... Starting in mid-April, the calculation will change when the new rules take effect. The Public Utilities Commission has estimated a payback period of nine years for Edison and PG&E residential customers who go solar after April 13, and six years for homes served by SDG&E.(LA Times)” Additionally, California is also requiring solar panels on the new construction. These new government regulations are a significant tailwind for Enphase

Financial Statement Analysis and Valuation

In addition to organic revenue growth, Enphase has also taken measures to improve its profitability during the solar slowdown. Despite a 2% yoy decline in Revenue, Enphase saw a 9% increase in EPS. As they have grown, the EPS margin has increased. In 2021, the EPS margin was 11%, and in 2023, the EPS margin was 19%. Part of this can be attributed to higher interest income and reduced interest expenses. Last year, Enphase announced it cut 10% of its workforce and approved a plan for up to $ 1 billion in share buybacks(Enphase Investor Relations).

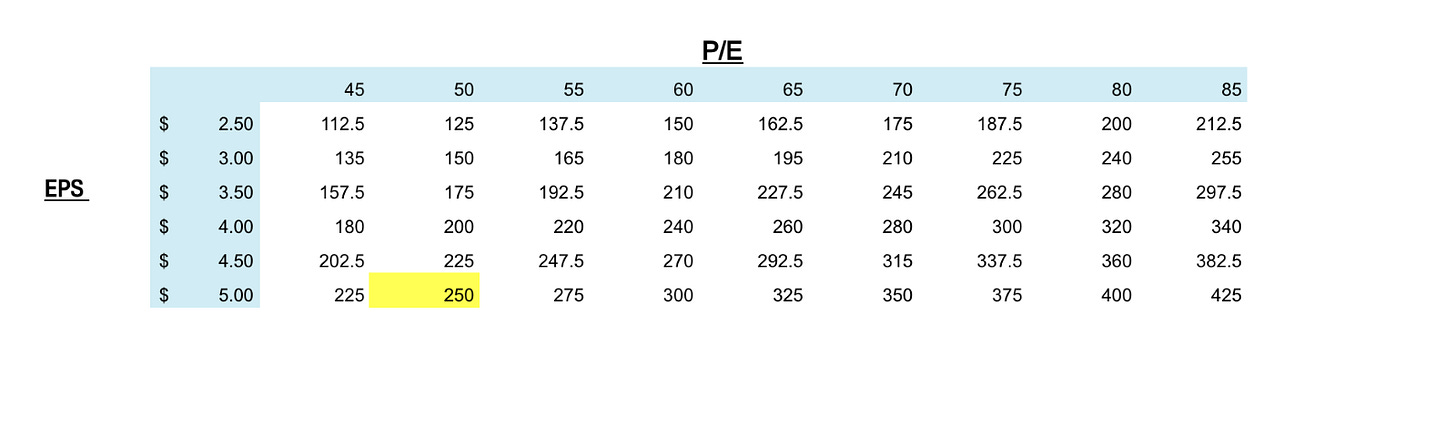

As organic growth for solar picks up because of the new government regulation, Enphase's multiple can expand and reach about 75x. Enphase’s multiple has contracted significantly, and rightly so. As solar adoption accelerates in Europe, the United States, and other parts of the world, Enphase’s revenue growth will improve, and its P/E multiple can expand. I have prepared a simple model from SEC filings below, including the average analyst estimates from the Tikr Terminal(tikr.com).

Risks

Policy changes can reduce demand for solar– Governments worldwide have recognized global warming as an issue and have created green policies that encourage the adoption of solar. For example, in California, NEM 2.0 offered attractive rates when residential solar sold electricity back to the grid. Under the next version of the law, NEM 3.0, the ratings were significantly less appealing, and that resulted in reduced demand. Eventually, as solar systems with an attached battery improved, it became feasible to have a positive ROI without high utility purchase payback prices. This sudden change in regulations created a reduction in the demand for solar. Currently, certain countries have high utility rates that promote solar demand, but in the future, if the policy changes, it could result in a slowdown in solar and drag Enphase’s revenue.

Highly competitive industry could cause Enphase Energy to lose market share – Solar is an extremely competitive market that is constantly innovating. Enphase’s completed with other inverter companies such as SolarEdge, Tesla, and Huawei. In the battery storage market, Enphase competes with Tesla, SolarEdge, Huawai, and LG Chem. If competition increases Enphase may have to reduce the average selling price of its products to remain competitive. A reduction in price would cause margin compression, reduced net income, and multiple contraction.

Supplier risk – If Enphase is unable to source its components used in its microinverters it could result in product delays and lost revenue. For Enphase, many of their components come from single source suppliers. If these suppliers cease supplying Enphase with the components used to manufacture microinverters and its other products they may not be able to deliver their products on time.

Interest rate risk – One of the major drivers of installation of residential solar in interest rates. Most people finance solar. If interest rates were to rise in the future it would increase the payback time for residential solar systems and consequently reduce demand for solar panel systems and Enphase’s revenue.

Because of new government regulations in Europe that require solar panels, Enphase can experience revenue growth. Sometime next year I anticipate Enphase to reach a share price of $250 based on 2025 EPS of $5.00 and P/E ratio of 50X

I loved this break down. Bought some shares in the dip as I agree with your logic on this. Thanks for the write up - I look forward to your posts.