Invest in AI, defense, and commercial aerospace with this connectivity powerhouse

APH Investment Memo

Amphenol ($APH)

Summary

Amphenol is well-positioned to benefit from the growth in electronics. Specifically, the company has been exposed to two growing trends: AI and aerospace. Amphenol offers connectivity solutions for IT data centers. AI data centers, in particular, are expected to grow an average of 33% yearly for the next ten years(McKinsey). Amphenol provides electronic solutions to help connect hardware and optimize power usage in these data centers. Additionally, they sell other connectivity products in various markets. Of these markets, mobile devices, commercial aerospace, military aerospace, and industrials are expected to see strong growth.

Investment Case

· Growth in Artificial Intelligence and Aerospace can help drive revenue

· Management has had a history of disciplined capital allocation strategy

· Continuing to focus on cost control can help improve already strong margins

· Strong entrepreneurial culture

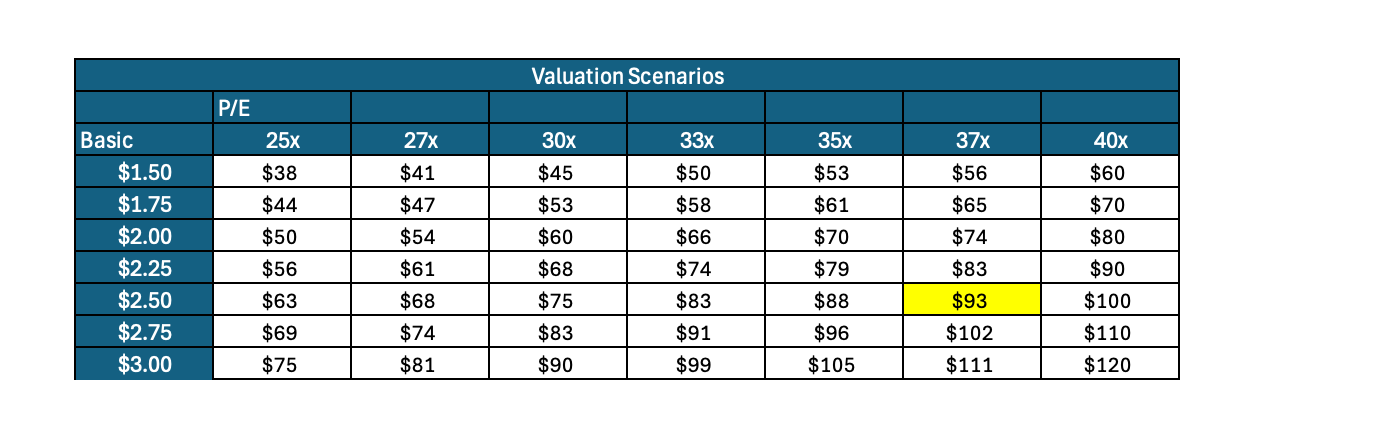

· Based on an EPS of $2.50 and a P/E ratio of 37x, I am assigning a one-year price target of $93

How does $APH make money?

Amphenol manufactures parts for various electronics. The company has three reportable business segments: Harsh Environment Solutions, Communication Solutions, and Interconnect and Sensor Systems. Please refer to the exhibit below for the revenue breakdown and examples of products sold in each segment.

Exhibit 1: Business Segments and Examples of Products(from company filings and company website)

Growth Drivers

IT Datacom – Amphenol is well positioned to benefit from the growth in IT datacom. APH provides power and other connectors for these datacom centers, and their sales should grow as companies build out their data infrastructure. I would divide the IT datacom market into two separate pieces: the traditional IT datacom market and the AI IT datacom market. In the recent past, there has been a slowdown in the conventional IT datacom market. COVID caused a pull forward in spending in the IT datacom market as companies strengthened their online digital infrastructure to accommodate remote capabilities. As we advance, there should be some normalization in the traditional IT datacom market. As mentioned before, the AI datacom market is expected to grow quite a bit, projected at an average of 33% a year. The world is going through an electronics revolution with generative AI. Gen AI requires a lot of computing power, Amphenol, creating demand for more outstanding IT infrastructure and, consequently, the electronic connectivity components that Amphenol supplies. Together, these submarkets are a significant revenue opportunity for APH

Although I covered IT datacom in detail, Amphenol services many other markets. I have included management’s estimates of growth in the table below. The estimates I have included in the valuation and financial analysis section are an average of the street’s estimates.

Exhibit 2: Markets breakdown and full-year management guidance(from company filings)

Financial Analysis & Valuation

Financial Analysis- Amphenol has solid financials and follows a disciplined capital allocation strategy. Top-line revenue is growing and is projected to grow modestly, driven by IT datacom and commercial aerospace. The street estimates that top-line growth is in the double digits. Although we saw a slight margin increase during the Q3 earnings call, and the street is projecting a 0.5% - 1% increase in margins, I wouldn’t be careful about projecting it forward since it is unclear where exactly these modest margin improvements are coming from. In addition, the balance sheet shows a strong cash position and acceptable levels of leverage

Capital Allocation—Management has demonstrated prudent capital allocation. They have repurchased 5.9 million shares, increased APH’s dividend to yield to 0.96%, and engaged in M&A activity.

Valuation – According to data from Tikr.com, Amphenol is at about a 40.0x LTM Price/ Diluted EPS (P/E) as of November 2024. This is close to its 10-year high of 44.98x. The 10-year average is about 29.10x. APH does seem a bit expensive at the moment. About a year ago, it was trading at around a 25x multiple. I want to remind people that a multiple is a shorthand way to calculate the value of a business, and implicit in the multiple can be many things, including but not limited to interest rates, margins, competitive positioning, and most importantly, expectations of future growth. With that in mind, I would say the valuation is reasonable, but investors should monitor the multiple closely to ensure that valuations become too inflated. Since we are projecting higher growth driven by IT data and aerospace, we can accept a higher multiple since our expectation of future growth has increased. If this is unclear you to you, don’t be shy, leave a comment. This can be tricky to wrap your head around and I can provide further examples.

Exhibit 3: Valuation Chart(tikr.com)

Exhibit 4: Valuation Table

Risks

1. Design changes at Nvidia—If Nvidia changes its design so that it does not require APH’s connectivity products, it may result in lower sales.

2. Slowdown in end markets—Although APH’s end markets are quite diversified, a slowdown in one or a few of them could decrease top-line revenue.

3. Raw Materials – APH requires a significant amount of gold and copper, and if the price of these materials rises it would be a drag on APH’s profitability

Conclusion

Overall, I would recommend that growth investors who want to participate in the electronics revolution pick up shares below $70. Investors should also carefully monitor the valuation and the new cycle for signs of an IT Datacom or aerospace slowdown.

Exhibit 5: Model

Thank you for reading, and leave your questions and comments below!