PayPal’s New Strategic Initiative And New Management Could PAY Off

Executive Summary

PayPal's stock is currently down about 75% from its peak in 2021. There are several reasons for this decline. The low interest rate environment has affected the present value of cash flows, leading to a boost in the valuations of many growth stocks. Typically, there is an inverse relationship between interest rates and valuations. Additionally, earnings decreased due to higher expenses. Consequently, PayPal's new management has decided to change the company's strategic direction.

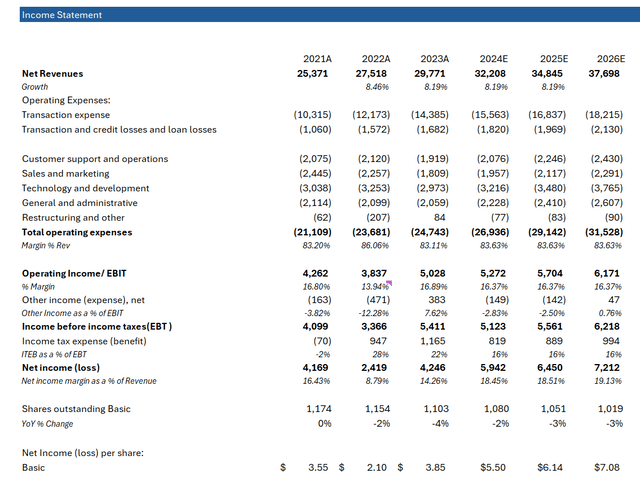

The market has reacted negatively to PayPal's decreased earnings, change in strategy, and the introduction of a new management team. However, looking ahead, PayPal is expected to experience modest revenue growth, slightly improved margins, and higher earnings per share (EPS). We may see some modest margin expansions as the company becomes more profitable. Furthermore, share buybacks could help increase the share price. Based on a projected EPS of $6.00 and a P/E multiple of 15, I am setting a one-year price target of $90 for PayPal.

Basic Information

Business Description

PayPal is a technology platform that enables digital payments and eCommerce for consumers and sellers worldwide. On the consumer side, PayPal allows users to exchange funds using various funding sources such as bank accounts, PayPal accounts, Venmo accounts, or other financial mediums that can store money. On the seller side, called merchants, PayPal enables customers to pay using electronic methods.

Going forward, Fastlane and the new ad Business can help drive revenue. Merchants may be intrigued to utilize these offerings as they can help improve conversion rates, especially on guest checkouts. By leveraging consumer and merchant data, PayPal can also foster the growth of its SMB business and the international segment. International transactions accounted for approximately 42% of PayPal’s net revenue. Below is a summary of PayPal’s products(10k).

Industry and Competitive Analysis

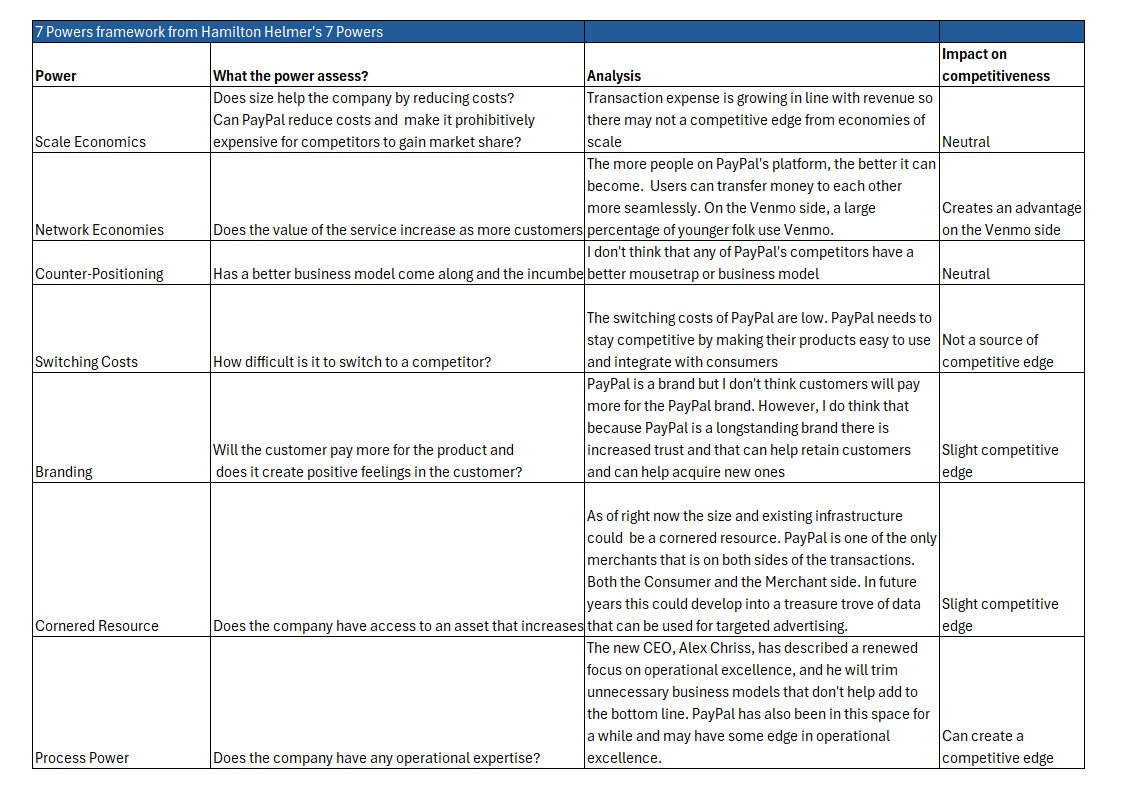

Using Hamilton Helmer’s 7 Powers framework, I completed a competitive analysis. Overall, I found that PayPal has a small competitive edge. It is difficult to quantify many of these competitive edges, but if I had found PayPal to have a strong competitive edge relative to its peers, I would have adjusted the multiple slightly. In this case, I won’t. Please refer to the table below for my detailed competitive analysis and my peer analysis chart(Seeking Alpha Peers tool and 7 Powers).

Valuation

I used a relative valuation method for my analysis. I forecasted a range of EPS and P/E values to establish a price range. The highlighted values indicate possible prices for PayPal. There has been online debate about PayPal being a value trap. However, I disagree with this assessment. Even though it currently has a low valuation compared to the 2021 multiple, I believe that PayPal is not a value trap. My argument is that PayPal has faced temporary challenges but is now refocused under new management. With a new CEO who is prioritizing profitable growth, there is potential for slight expansion in net income and, consequently, an increase in the multiple.

Risks

- Increasing competition in the payment industry could lead to a decrease in PayPal's market share.

- PayPal's business is reliant on discretionary spending, which may decrease in the event of a macroeconomic slowdown.

- If the new management is unable to execute their strategic initiatives, PayPal's top line and net income will fail to grow.

Why does the opportunity exist?

PayPal missed earnings and abandoned its previous financial objectives in 2022. It also has higher expenses, which reduced net income. My view is that those expenses were one-time expenses and, in the long term, will help the company become more focused. In the 10K filed in 2023, it states that those higher expenses were “driven primarily by losses on strategic investments, and an increase in income tax expense of $1.0 billion primarily related to lower benefits associated with stock-based compensation deductions, and higher expense related to intra-group transfers of intellectual property.”

The market is reacting to PayPal's short-term weakness and change in strategy, but it tends to be short-sighted.

Are you worried about Apple Pay/Google Pay and the increasing competitiveness of the payment space?

I am worried about the growing competitiveness of the payments space, but the world is a big place, and there will be room for multiple payment players. Previously, the discussion focused on which companies would grow the most without consideration of profitability. PayPal’s new strategic initiative is focused on finding more profitable users who are more engaged with the platform rather than having as many users as possible.

Thank you for reading!

Please don’t hesitate to comment on the post or reach out to me via email, Twitter, Substack, or Discord.

-Psy