Stylish footwear and apparel brand that can double revenue in the next two years

Consumer footwear brand

On Holding AG(ONON)

Investment Case

On is growing quickly, from 2021 to 2023, On has had a revenue CAGR of approximately 39%

In 2023 On Holdings management set a revenue target of doubling net sales by 2026 and expanding its adjusted EBITDA to 18%

Based on its high growth rate, ONON could trade at a higher multiple

A strong brand image can help ONON grow and charge a premium for its products

ONON can increase market penetration in China and other countries

What is the opportunity here?

OnCloud manufactures footwear and apparel around the world. They focus on key areas including Run, Training, PAD(lifestyle), Tennis, and Outdoor. In 2023, they did 1.76 billion in sales at a 15% EBITDA margin. By 2026, Management plans to increase its net sales to above 3.55 billion in CHF and an adjusted EBITDA margin of greater than 18.0%.

Market

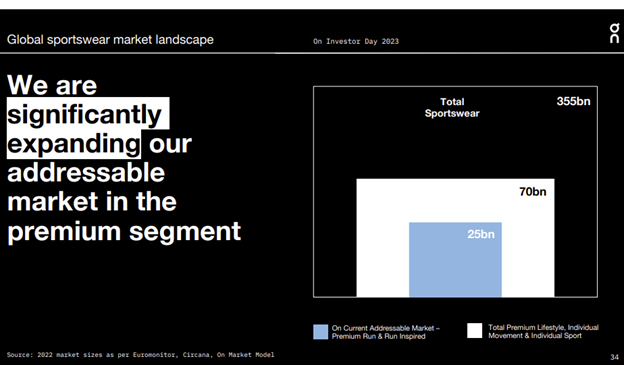

Global footwear and apparel is a large market dominated by entrenched incumbents such as Nike, Adidas, Puma and others, OnCloud has been able to gain a foothold amongst these competitors since they have come up with new technologies that provide greater support for your feet as you exercise. In addition to the new technologies, they also have very sleek branding as well. According to their estimates, the market for Premium run is 25 billion. One could also further expand into apparel as well. Although the total sportwear market is large at $355billion and I pend their apparel very stylish, I haven’t observed as much innovation in their clothing when compared to their footwear.

Financial Analysis and Valuation 1

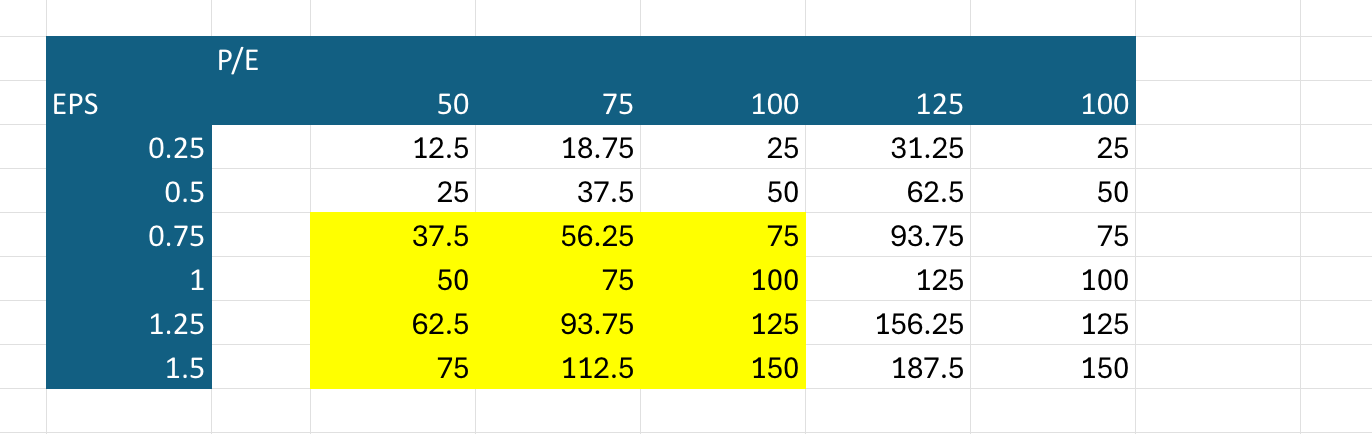

I’m going to save us some word count here and throw out some numbers. This is a simple setup. It’s a fast-growing consumer brand in a large market. If management can execute its plan to double revenue in the next few years and achieve modest (margin improvement, we can expect some share price appreciation. Please see the models below for a range of price targets based on various EPS’s and Price to earnings ratios. I estimate a price of $93.75 in the next two years based on an EPS of $1.25 and a P/E of 75x.

Risks

Ability to Maintain Brand image- A brand has a competitive advantage if its consumers are willing to pay a premium for its products. If On cannot maintain its premium brand image it will not be able to charge a premium price for its shoes. On’s running shoes are marginally more expensive than some of its competitors. Take for example the very stylish(if you have seen me recently you would know that I sport these right now) fade/sand cloud eclipse 3, a running shoe in the maximum cushioning segment. According to On’s website this shoe sells for $180 us dollars. Compare that to Decker’s HOKA maximum cushion running shoe the Men’s Clifton 9 which sells at $145. This is an almost 25% difference in price. In my opinion, I have worn both these shoes. They are both excellent shoes and of similar quality.

Business Risk – A majority of On’s revenue comes from a single discretionary product. Upscale running shoes. They may not be able to sustain the same growth as compared to the last couple of years. Although management has a plan to double revenue, if there is a global recession or other environmental challenges, they may not be able to grow as anticipated.

Competitive market – Although I believe On has a slight competitive edge with its brand pricing; the company nonetheless operates in a very competitive market. Its competitors are large, entrenched incumbents such as Nike and other athletic gear focused companies. They may be able to take actions such as enact pricing pressures or increase their marketing efforts to capture more sales.

Conclusion:

Overall, I recommend this for growth-oriented investors at a price of around $50. I would expect to hold this for about two years. High growth companies such as this have high multiples. If On was able to double it’s revenue in the next few years, the odds of doubling their revenue again in the next few years would be significantly reduced. At that time there would be multiple contractions due to slowed growth rate.