This technical apparel maker could be poised for a bounce-back

Investment Case

International Growth could be a revenue opportunity for Lululemon in the future.

A negative sentiment overhang due to domestic competition from other brands has caused the P/E multiple to contract.

The lower multiple is justified, given the slowdown in sales and increased competition; however, EPS is still growing.

Management has authorized a 1 billion share repurchase program.

I am assigning a price target of $465 based on an EPS of $15.50 and a P/E multiple 30x; this is a 22% upside to the current share price.

Business Description

Lululemon Athletica is a vertically integrated premium sportswear brand. The company focuses on innovative products made of technical apparel that sell at a premium. Although it focuses on activewear, the company has recently expanded into other categories, such as men’s business casual and footwear. In 2023, women represented 64% of net revenue, men represented 23%, and other products comprised 13%. LULU organizes its business through three primary operating segments: the Americas (79% of 23’ revenue), the rest of the world (11%), and China Mainland (10%). In the past few years, revenue Growth in the Americas has been relatively flat, while revenue in China has been growing very quickly. Please refer to the revenue table I have prepared below to help understand the revenue trajectory and trends.

Why does this opportunity exist?

The North American market comprises the bulk of Lululemon’s revenue.

In the past few years, there has been competition from several other premium branded activewear companies. These companies include Alo, Vuori, Athleta(owned by GAP) and Rhone. These new athleisure brands and other activewear brands such as Nike, Adidas, and others now represent serious competition for Lululemon. In the last year, despite a recovery in EPS, Lululemon’s stock has remained mostly flat. Lululemon has remained flat due to the contraction in the multiple. The multiple has contracted from 59.72x to 31.8x due to concerns that LULU could not sustain its high growth rate. This is a very valid concern. However, although somewhat modestly, Lululemon can continue to grow due to its international expansion plan. The Chinese government has also introduced plans to stimulate consumer spending and boost the economy. Although the multiple may not return to its 50x high, Lulu could see moderate multiple expansion and more EPS growth as it expands internationally.

As for the domestic front, Lululemon is still a great brand. Although the new-age competitors are trending in North America right now and are of a similar price point, I don’t see the same quality. For example, Lululemon products offer more sophisticated stitching and technical fabrics. The clothing also offers additional finishing touches that make the clothing feel more premium. Unless the new competitors improve the quality, consumers may find it hard to continue to justify the premium pricing.

Since the competition spooked investors, this would be an excellent opportunity for investors to pick up Lulu at a discount. We’ll have to monitor the sales trend and see how consumers respond to these new trends.

Competition

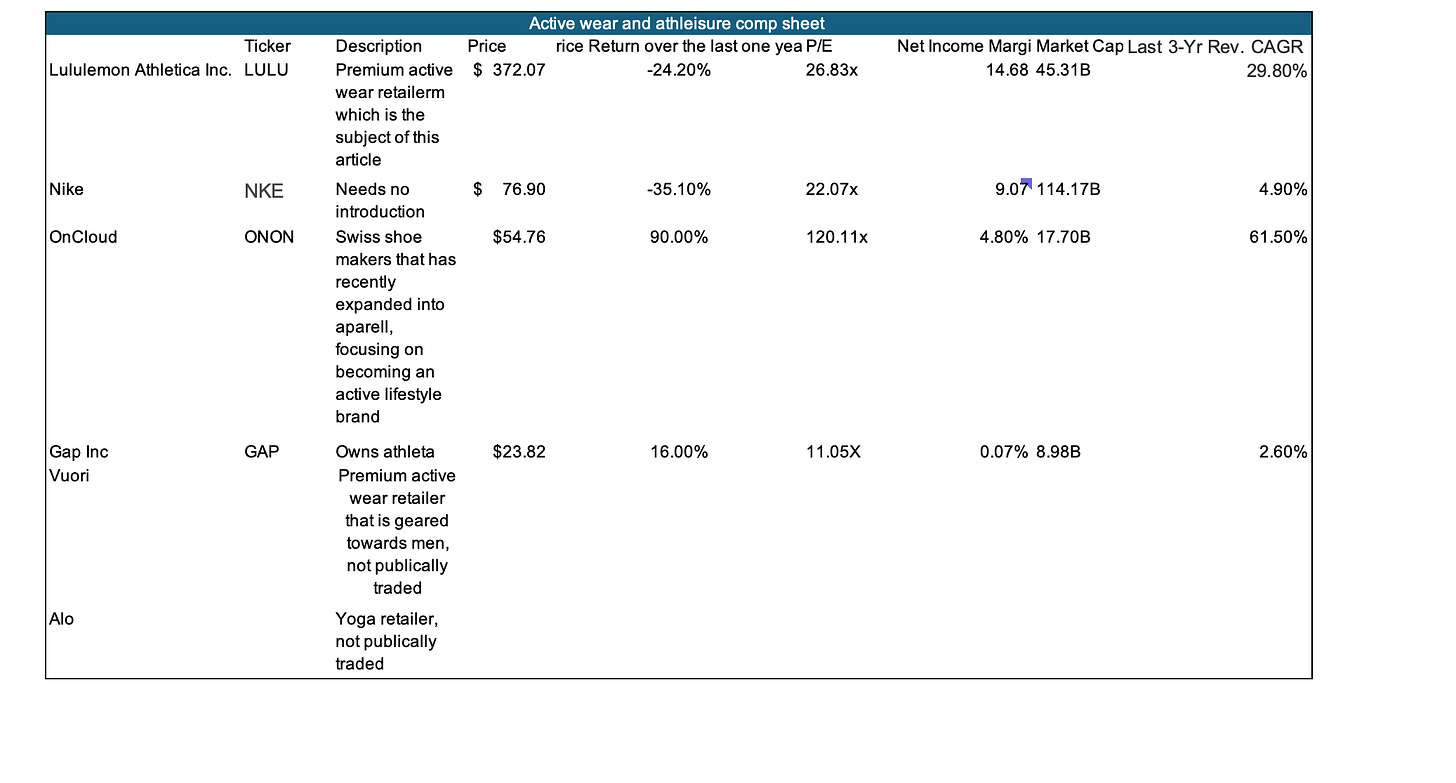

Please see the table below for details on competitors. I have included revenue growth rates, margins, and multiples to know where the different publicly traded competitors are trading.

Valuation

As I mentioned, Lululemon’s multiple has dropped primarily due to concerns about its ability to maintain sales momentum and increased competition in the athleisure market. The average P/E in the last 5 years was 52.19x. Lululemon had a high of 91.59x and a low of about 18.72x. The most recent P/E, as of December 2024, is 28.10x, and this would.

Overall, I don’t anticipate Lululemon reaching its previously high P/E of close to 50x. I believe the P/E can stay in the low 30s due to its international growth story and if it can retain its margins. If you compare Lululemon with Nike, you can see that NIKE has a P/e of 22, with a 9% income margin and a 3-year revenue CAGR of 4.90%. Compare that to Lululemon, which currently has a P/E of 26x, a 14.68% net income margin, and a 3-year revenue Cagr of 29.% Although both companies are trading near their 5-year lows, we could see multiple expansions if growth picks up internationally.

Financial Analysis

Another point I would like to highlight is the dip in EPS 2023. From 2022 to 2023, Lulu’s EPS dipped from $7.49 to $6.68 despite an almost 30% growth in revenue. Then in 2024, it nearly doubled to $12.20. The dip in EPS was due to impairment charges related to Lululemon Studio and other assets. Despite slightly slower growth, about

Lululemon’s management has authorized a share repurchase program of 1 billion dollars. This represents about 2% of Lululemon’s 46.17 billion Lululemon’s market cap. It should produce a modest boost in EPS and signal to shareholders that management has them in mind.

Model

Risks

1. A slowdown in consumer demand could cause further multiple-compression

2. Expanding internationally could cause operational issues and hurt EPS

3. Lululemon could struggle to charge its premium pricing due to brand image